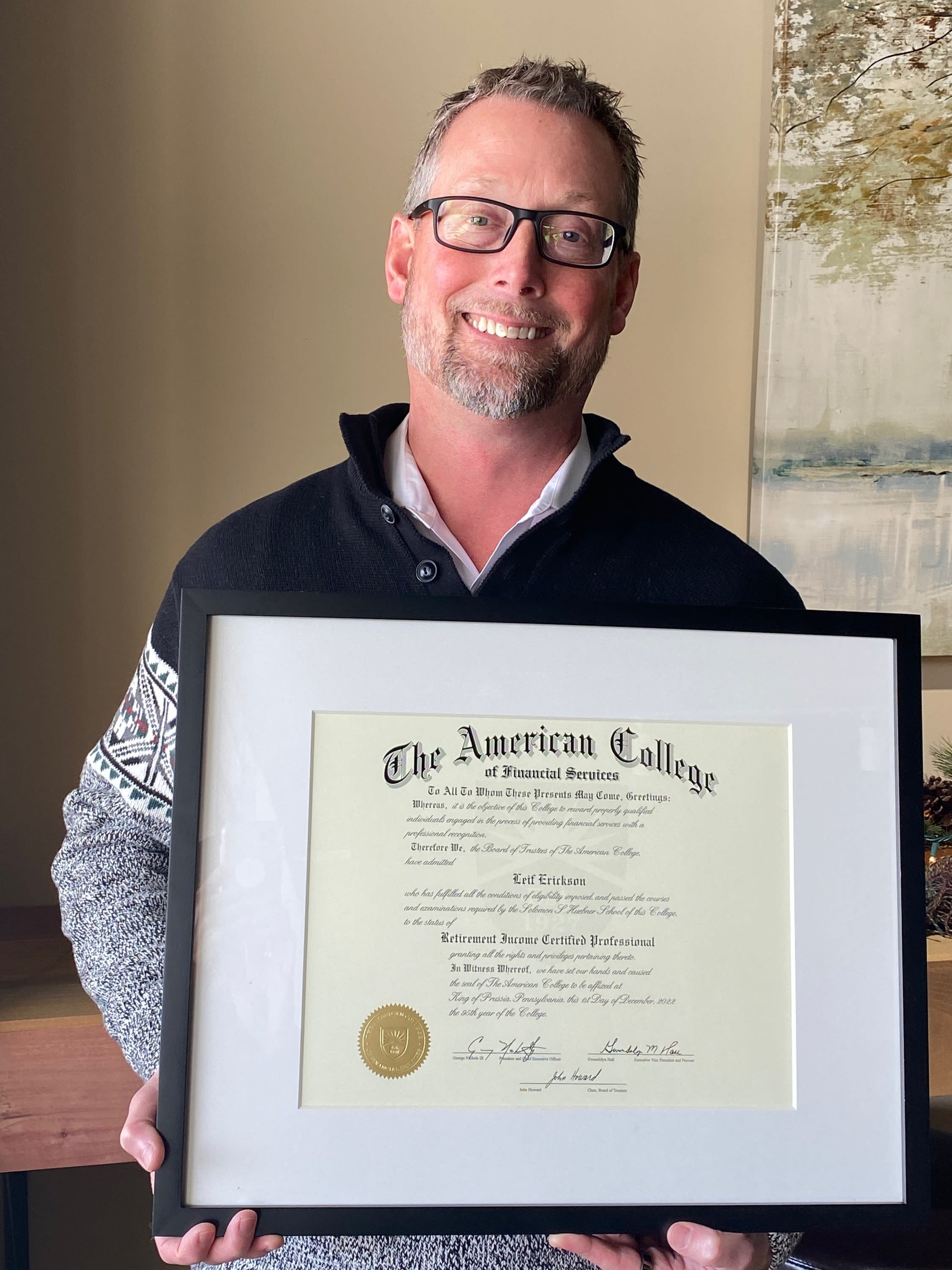

Leif Erickson, BFA™, CEPA®, RICP®, Financial Advisor

Leif Erickson, BFA™, CEPA®, RICP®, Financial Advisor

Categories

*Finance & Insurance Insurance Financial & Investment Services

About

Leif is passionate about helping clients manage their finances through the different seasons of their lives. He focuses on retirement, estate and tax planning strategies for individuals, business owners, and their families.

His certifications as a Retirement Income Certified Professional® and a Behavioral Financial Advisor™ help him advise his clients on virtually any financial issue.

Leif has been recognized as a Five Star Wealth Manager in 2022 and 2023. (learn more about this award here). and is currently serving as an elected member of the Forest Lake City Council (2023 - present).

Along with his wife, Chelsea, Leif enjoys traveling, motorcycling, and quiet evenings on Forest Lake with family or friends.

Personal Financial Services

We’re here to help you thrive. Using our comprehensive process, we'll take a 360° look at your current financial position, identify strategies to address your needs and build a customized plan to help you get from where you are to where you want to be, while focusing on the topics most important to you.

What can you expect?

Our services include:

- Goal Development and Personal Values Assessment, to align your goals and financial tools with what matters most to you.

- Financial Net Worth, including full digital and print net worth statements.

- Investment Analysis, a comprehensive review of your current investments through multiple filters including expense management, investment return, tax efficiencies, and risks to determine best solutions for you.

- Tax Analysis and Planning, using our 37-point checklist developed by CPAs, this analysis will help you maximize your tax efficiencies now, as well as illustrate the impact of tax strategies throughout retirement.

- Risk Management Analysis, three unique analyses designed to ensure you’ve prepared for the certainty of uncertainty.

- Retirement Income Planning, including Secure Income Modeling and Total Income Modeling to identify potential retirement income shortfalls so you can address them as quickly as possible.

- Social Security Optimization, to not only identify which strategy may pay the most, but more importantly, which is the right strategy for your plan.

- What-If Worksheets, to model up to five different retirement scenarios.

- Plan Summary, detailed, easy to read written recommendations so you know exactly what the next steps are to address any gaps in your plan.

We accomplish all of this and more through a series of high-impact Strategy Sessions, as well as our team working for you behind the scenes. We typically meet, either in person or by Zoom, six times over the course of the year.

These Strategy Sessions are intentional and designed with educational elements to provide you with greater peace of mind and confidence as you prepare for and move into retirement.

It all starts with a conversation. Click here to pick a time to get started.

Additional Info

2022 FLACC Business of the Year, 2023 FLACC Business Advocate of the Year, 2022, 2023, 2024 and 2025 Five Star Wealth Manager

Driving Directions : Our Office overlooks beautiful Lakeside Memorial Park.

Business Hours : 8:00 AM - 5:00 PM, Monday - Friday

Images